I’m bringing this to you again because there remains an inability to understand TIF and the negative effects on a community. Below is a link to a report that was based on studies using models from Chicago. This report was found using the google search term “free lunch“. The study focuses on using TIF for development, although many aspects would still apply to using TIF for funding whatever a DDA or TIF district decides to fund (including picking winners and losers).

I’m bringing this to you again because there remains an inability to understand TIF and the negative effects on a community. Below is a link to a report that was based on studies using models from Chicago. This report was found using the google search term “free lunch“. The study focuses on using TIF for development, although many aspects would still apply to using TIF for funding whatever a DDA or TIF district decides to fund (including picking winners and losers).

Blissfield’s development application used TIF to finance paving and beautifying the parking lots downtown, without having to get the taxpayer’s permission. Our DDA has been collecting TIF revenue from the district for their operating budget since 1992.

The Right Tool for the Job? An analysis of Tax Increment Financing

From Developing Neighborhood Alternatives, a collaboration of 4 organizations. The full report is available for purchase, the above link will provide you with the summary. Please read it.

Overview

Tax Increment Financing (TIF) is an economic development tool that uses the expected growth (or increment) in property tax revenues from a designated geographic area of a municipality to finance bonds used to pay for goods and services calculated to spur growth in the TIF district. The analysis performed for this study found TIF does not tend to produce a net increase in economic activity; favors large businesses over small businesses; often excludes local businesses and residents from the planning process; and operates in a manner that contradicts conventional notions of justice and fairness. We recommend seeking alternatives to TIF and reforms to TIF that make the process more democratic and the distribution of benefits more fair to residents of TIF districts.

Here is point five of the summary;

5. TIF violates conventional notions of justice and fairness.

Communities consist of people as well as places. Their residents are united by interests as well as geography, though often those interests do not exactly coincide. To celebrate community is not to justify all opposition to change or to romanticize old neighborhoods, but to recognize that current residents and business owners have the right to participate in decisions that affect their communities. They’ve earned that right. Decision-making procedures must be designed to give them meaningful participation.

TIF threatens communities when it prevents people from being able to participate in collective decision-making at the community level and to be recognized for their contributions. It damages communities when it compels people to sell their property and leave the neighborhood, breaking the many invisible bonds that make neighborhoods safe and life worth living. And it undermines communities when it moves authority outside the neighborhood, giving it to people whose interests are different from those of the people affected by their decisions.

Two definitions of justice that win widespread support are equal treatment under the Rule of Law, and justice as fairness. The three historical tests of just laws are that they be negative, general, and unchanging. The case studies found TIF failed to meet all three tests. The case studies also show TIFs fail the test of justice as fairness because those who propose and implement them would seldom choose to change places with the small business owners who face subsidized competition, low-income renters who are forced to leave the community, or property owners whose buildings are condemned to make way for a more-favored developer.

Although the following video isn’t the most dynamic to watch, the message provides the basics of this funding and clarifies one huge downside of TIF – everybody’s taxes increase 10% to support it.

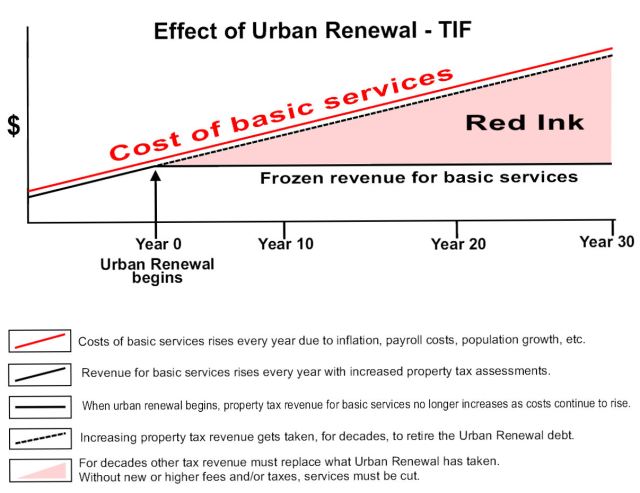

Brownfields operate in the exact same manner of using a base assessment value before development and a forecasted assessment of value after development and capturing the incremental increases of taxes. The distribution of taxes to schools and services like water, sewer etc. remains the same as the base levels for the next 20 – 30 years as set out in the agreement.

The taxpayer ends up making up the difference to these underfunded services. Instead of private developers and the private market funding development as profits can be logically predicted and investment deemed worthwhile. Government decides what is profitable and the taxpayers underwrite the whole project, by mandate.

Tax increment financing or Facade grants and the like are nothing short of Corporate Welfare – government subsidizing. Everybody probably understands there is no free money here or anywhere and there is no such thing as a ‘free lunch’.

Informative video. It sure echoed how certain individuals in Blissfield were able to get special treatment!

Even if everybody’s property was to be included in the TIF District and we all could urban renewal our homes with grants, etc., we would still be footing the bill. I like the more win/win situations (as in everybody wins fairly).

Robin, you are outstanding. I read your essays, yes essays-not blogs and am moved and amazed. And I know you will break through the political miasma and make a difference. Remember the numerous struggling voices when you do. There are many ‘Blissfields’ in Michigan. In the meantime, I would like to quote you. The 3 paragraphs under #5 describe what has happened to our little rural area without TIF! Quietly in your corner.

Gnotekp, you are free to use any of the information provided, anytime (along with proper credit for sources). It’s all about helping each other and getting ourselves to a place of self sufficiency and integrity. It’s individuals that will make a difference in the end, it’s individuals like you! My hope is that Blissfield will be answering the call and help all those other ‘Blissfields’ in Michigan.

Thank you for your compliment, you are too kind. I don’t know about quietly, but I’m also in your corner.